What a difference one year makes!

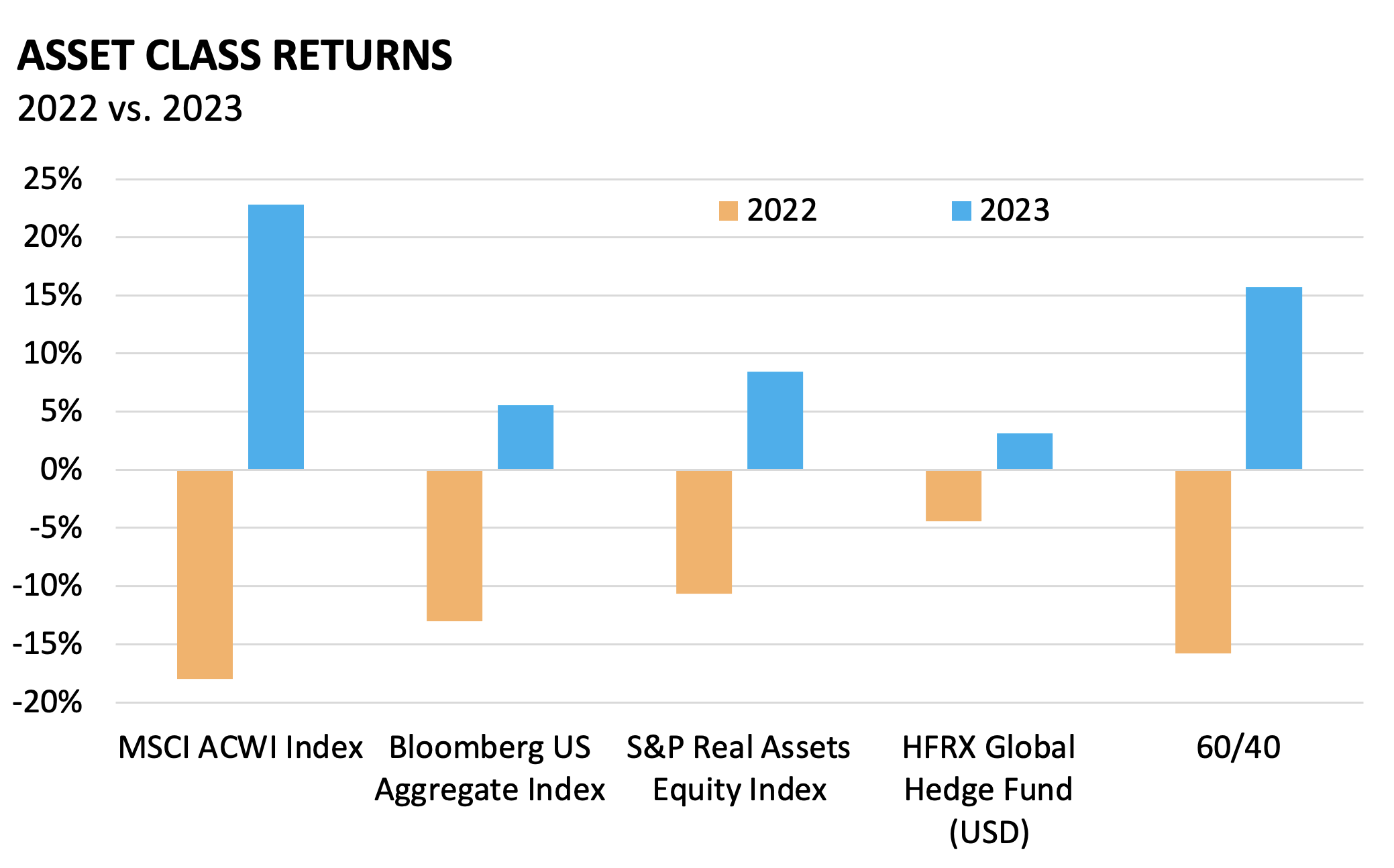

2023 was a good year for investors, and the fourth quarter was especially kind, with nearly all major asset classes having a positive year.

In fact, 2023 appeared the opposite of 2022. The traditional 60/40 portfolio of stocks and bonds declined double digits in 2022; however, the same mix increased double digits in 2023.

In this Loop post, I explore the key drivers behind 2023 positive returns and FEG’s views on the year ahead.

Key Driver: The “Magnificent Seven”

Kathryn Mawer, FEG

The prevailing theme of 2023 was what investors have become accustomed to in recent years: U.S. equities outperforming non-U.S. equities, large cap outperforming small cap, and growth outperforming value. Helping lead the U.S. equities performance was the “Magnificent Seven.”

With the new technologies and innovation such as ChatGPT, the group of big U.S. tech stocks – Google, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla – within the S&P 500 index were dubbed the “Magnificent Seven.” While in 2022 their performance plunged 45.3%, they recovered those losses and then some, seeing a 107% total return in 2023.

For 2024, we will watch to see how the percentage of the Magnificent Seven within the S&P 500 Index (28%) and their earnings contribution (20%) align. Only time will tell if the earnings increase to catch up with the stock price, or if the stock price falls to meet earnings.

Key Driver: Inflation and Fed impacts on Markets

Last year annual inflation declined from its peak of 9.1% in 2022 to 3.1% in November 2023. The Federal Reserve’s rapid increase in interest rates – 11 times from 2022 to summer 2023 – helped reduce the inflationary pressures. Since then, the Fed has been in a holding pattern as they work towards a “soft landing” for the economy. (A soft landing is considered a return to low inflation, seen by the Fed rate of 2%, while maintaining economic growth.)

One risk to the Fed’s landing is a resurgence in inflation. Despite today’s diminishing inflation, historically, it comes in waves. Often inflation will ease only to increase again.1 While there is a potential that today’s inflationary environment is the exception to the rule, a return of inflation is something to watch for in 2024.

The Year Ahead

Two other potential risks for the markets in 2024 are geopolitics and the U.S. elections.

Geopolitical concerns have been rising with the Russia/Ukraine war, tensions between China and Taiwan, and conflict in the Middle East. While overall impact of geopolitics has historically not had an impact to markets, some recent areas of economic stress include the decline in shipping through the Suez Canal.

The 2024 U.S. election is expected to be tumultuous and adds a layer of uncertainty and stress to markets. A recession would likely add to the tensions.

In Conclusion – Keep the Focus on the Long-Term (and Don’t Overreact to the Short-Term)

“The world is full of foolish gamblers, and they will not do as well as the patient investors.”

–Charlie Munger, one of the world’s greatest investors who passed away in 2023.

While we saw what a difference a year can make, it is important investors don’t overreact to the short-term for either the positive or the negative, and instead keep the focus on the long-term. Continue to think as a patient investor: remain vigilant and well informed about the markets and any uncertainties, and steadfast in one’s investment approach.

1 Data source: FactSet, as of 12/31/2023.

2 Strategas study of occurrences where inflation peaked above 6% across 23 developed countries since 1900. In 87% a multiple wave of inflations occurred. Of the single waves, none took place in the U.S.

The Community Foundation prudently invests charitable funds so they may strengthen the community for current and future generations, carrying out our generous donors’ wishes to impact their communities and make a difference in the lives of all. Our investment strategy is managed by our Outsourced Chief Investment Officer (OCIO) Fund Evaluation Group (FEG) Investment Advisors, whose advisors are working with our volunteer investment committee members, who are local experts in investment and finance. Learn more about our investment strategy.

Leave a Comment