Nonprofit Agency Funds

Give your backers a way to provide financial support for your organization for the long term

Establishing an agency endowment fund with us is a simple and efficient way to build an ongoing source of income for a nonprofit organization.

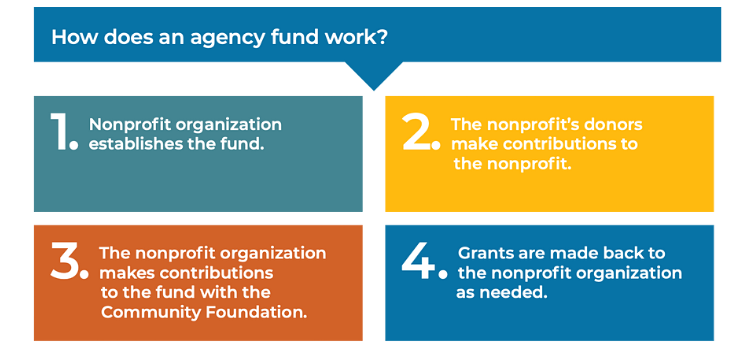

The Community Foundation for the Fox Valley Region makes it easy to establish, maintain and grow an agency fund that allows your organization to steward endowments or operating reserves expertly, while not taking valuable staff time away from your mission.

Here’s a snapshot of how it works:

Give – Transfer cash, stock, or other assets from your organization to your agency fund at the Community Foundation.

Grow – The Community Foundation invests funds using diversified pools managed by professional investment managers.

Grant – Set up annual distributions back to your organization or request grants from the fund to your organization.

A Guide To Agency Funds

The Community Foundation makes it easy for your organization to set aside and invest funds for the future. Agency fund services include:

- A cost-effective option for accessing investment options that might not otherwise be available to your organization.

- Agency can focus on building assets without the burden of managing investments.

- 24/7 online access so your organization can view the fund balance, contributions, grants, and investments anytime.

- Donors have peace of mind that investments are well managed.

- A member of the Agency Fund Team can meet with your staff, board, or finance committee to review the investments of a fund(s).

- Familiarity and expertise with a wide range of planned giving options, including serving as a sounding board for growing your fund and assisting with accepting complex assets.

- Adept financial knowledge in navigating the specific accounting standards that are unique to this type of fund.

Contributions may be made by your organization into a fund at any time.

- Cash contributions may be delivered by check or wire transfer.

- Checks should be made payable to the Community Foundation for the Fox Valley Region with the specific fund name listed on the memo line.

- Large cash contributions may be transferred by wire directly to the Community Foundation’s bank account. Contact the Community Foundation for wiring instructions and notification prior to making the transfer.

- Publicly traded stocks, bonds, and mutual fund shares are accepted. Please contact the Community Foundation for assistance with stock contributions. Please contact us prior to transferring shares to let us know the stock name and number of shares to be transferred. We request notification before a transfer is initiated.

- Contributions of complex assets, such as business interests or real estate must be reviewed and approved before they are accepted (via the Community Real Estate and Personal Property Foundation, a supporting organization of the Community Foundation) and additional requirements or fees may apply.

Third Party Contributions – Individual donors may not make contributions to an agency fund at the Community Foundation. Individual donors may contribute to your organization for the purpose of supporting the agency fund, or they may create a designated fund at the Community Foundation to benefit your organization. (Ask our gift planning staff for more information about designated funds.) The Community Foundation does not support fundraising activities by your organization and cannot accept gifts into the fund from donors generated by those activities.

Estate or Legacy Contributions – The Community Foundation can receive distributions from charitable trusts or bequests from an estate on behalf of your organization and create a designated fund. We work with your donors across the full range of planned contributions, including bequests, beneficiary designations, and charitable trusts to receive assets for the future of the designated fund. Again, individual donors, or their estates, may not contribute to an agency fund.

Minimum Initial Contribution – A minimum contribution of $10,000 is required to establish an endowed agency fund. There is no minimum for a non-endowed (spend-down) agency fund.

Future Contributions – Additional contributions may be made by your organization to an established agency fund in any amount and at any time.

An agency fund can be set up to distribute grants to your organization annually (automatically), or the fund advisor can request grant distributions through the fund advisor portal. Please contact us if you have questions about the distribution schedule for your organization’s fund.

The Community Foundation provides an online fund advisor portal to provide a secure and easy way through which you can access fund information. Depending on the type of fund you advise and your role with your organization, you may be able to view the latest fund balances, make grant recommendations, and/or review gift history.

Log into your Fund Advisor Portal here.

Who can use the fund? Agency Funds allow one person affiliated with your organization to be Fund Advisor. Only the person(s) authorized are able to discuss fund information with the Community Foundation, request a distribution, and/or change investment options. If a transition in staff or board members has occurred in your organization and you’d like to change who is authorized, please email [email protected].

How many logins do we get to access the Donor Portal? While there can only be one authorized Fund Advisor, multiple people within your organization may have View Only access to the Fund Advisor Portal to review Fund Statements.

I want to update the fund’s information. Can I do that in the Fund Advisor Portal? If you want to update details for the fund, please email [email protected].

How will I know if I submitted a grant successfully? You can check the status of the grant in the Fund Advisor Portal, on the Grants tab.

How long does it take to process a grant recommendation? Grant recommendations received by end of day Friday will be in the que for due diligence review the following week. On average, grants are processed within two weeks of recommendation being received. Processed grants are paid out via check or EFTs on the Tuesday following the week of due diligence.

What does Grants Payable under Outstanding Fund Liabilities mean? Grants are recorded in the month they are recommended regardless of scheduled payment dates.This accrual accounting entry simply ‘reserves’ the funds for future payment. The funds are NOT pulled from the investment account until right before the grant is actually paid out and continues to earn interest and gains/losses until that point.

How do I access a copy of the fund agreement or other related documents to the administration of the fund? The Community Foundation provides all Agency Fund holders a copy of the fund agreement at the time a fund is established. The Fund Advisor may request a copy at anytime. Please email [email protected] for document related requests.

The Community Foundation takes very seriously the obligation to steward the charitable funds with which we have been entrusted. The overarching investment strategy for all portfolios is to preserve and grow capital, helping to ensure that donors’ charitable assets benefit causes now and for generations to come. All investment guidelines and options are reviewed at least annually by the Community Foundation’s Investment Committee for approval by the Board of Directors and may change from time to time as the Board of Directors determines.

Endowed vs. Non-Endowed (spend-down) Funds

Funds are classified at the Community Foundation based on the timeframe for use of the fund selected by your organization. Nonprofits have the option to create an endowed fund that will be managed by the Community Foundation in perpetuity or a non-endowed fund that allows flexibility to grow, spend, or sunset as needed.

Endowed Agency Funds are permanent funds

The decision of your organization to restrict an agency fund as an endowment is binding on your current and all future boards of directors. The spending restriction is enforced by the Community Foundation Board of Directors.

Assets in all endowed funds are managed with the goal of preserving and growing the principal in perpetuity. Only the “spendable amount” is available for distribution each year and is limited to the spending rate of the fund’s average balance. An endowed fund should only be chosen to preserve the principal of the fund for future generations, not for short-term needs.

Endowment Spending Policy – Endowed agency funds are administered under the spending policy approved by the Community Foundation’s Board of Directors and guided by the Wisconsin Uniform Prudent Management of Institutional Funds Act (UPMIFA). The Community Foundation’s standard endowment spending policy is up to four and half percent (4.5%) of the rolling 12-quarter average of the principal market value of the fund, excluding undistributed amounts for distribution. Endowment funds having a principal value less than $10,000 as of June 30 of any year, shall not be subject to the calculation.

Non-Endowed agency funds are not permanent funds. Non-endowed funds (also known as “spend-down” funds) allow the organization maximum flexibility in structuring the fund because the entire principal is available for distribution. Non-endowed funds have the option of three investment pools – short, intermediate, or long term to align with your organization’s intended purpose of the fund.

Investment Committee Oversight – The Community Foundation’s Investment Committee sets investment strategy and monitors investment performance against industry benchmarks. Committee members have extensive expertise in business, investments, and financial matters.

FEG Investment Advisors – As of March 1, 2020, the Community Foundation’s investment strategy is managed by our Outsourced Chief Investment Officer (OCIO), FEG Investment Advisors. FEG works with our local volunteer investment committee members who are experts in investment and finance.

More Investment Information – For more investment information, please visit our website here.

Administrative Fees – The Community Foundation assesses an administrative fee to each charitable fund to cover the cost of administration and to continue the Foundation’s important work within the community. Administrative fees are calculated using the average daily fund balance from the prior month. The growth of the Community Foundation has provided the ability to retain a reasonable fee schedule for agency funds. Please visit our website for more information.

Investment Management Fees – In addition to the administrative fees, each fund is assessed a pro-rated share of investment management fees charged by the investment managers hired. The investment fees depend on the portfolio the fund’s assets are invested in and may vary.

Creation of the fund:

Debit: Beneficial Interest in Assets Held by community foundation

Credit: Cash

(Assets and net assets are measured at present value based on the expected future cash flows to the non-profit)

Ongoing entries:

The nonprofit’s interest in the endowment fund at the Community Foundation is similar in nature to an interest in a perpetual trust – in that the non-profit has an interest in a future income stream from the trust. As with a perpetual trust, the non-profit generally does not have access to the principal value of the assets held in the Community Foundation endowment fund (under the terms of the fund agreement).

Based on the premise that a non-profit endowment fund is like a perpetual trust, the following accounting entries would be made throughout the life of the fund to account for changes in value and distributions from the assets held at the community foundation.

Income payments during the holding period (distributions received)

Debit: Cash

Credit: Investment Income

Periodic Valuation (changes in value of the endowment fund)

Debit: Beneficial interest in assets held at community foundation

Credit: Gain or Loss

What is an agency fund?

An agency fund is a type of designated fund established by a charity at a community foundation for the charity’s own benefit or the benefit of a related entity. The donor or resource provider and the beneficiary recipient organization are the same entity. When the agency establishes the fund, the variance power and legal ownership over the asset is transferred to the community foundation.

What types of organization can establish an agency endowment at a community foundation?

A public charity under Section 509(a)(1), 509(a)(2), or 509(a)(3) may establish an agency endowment at a community foundation. This may include an endowment created by a government unit. A community foundation should not establish an agency endowment for a private foundation or non-charity.

When a public charity establishes an agency endowment at a community foundation, which organization owns the contributed funds?

The community foundation has legal ownership of funds contributed to an agency fund. As such, the community foundation’s board has fiduciary responsibility over the funds. The legal ownership of the funds is a frequent source of confusion between agencies and community foundations.

Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 958-605-15-8 requires that an agency recognize a beneficial interest in the assets held by a community foundation as an asset on the agency’s books. While ASC 958-605-15-8 requires the agency to recognize a beneficial interest in the assets held by a community foundation, the ASC only affects the accounting treatment of the funds, not the legal ownership.

Since the agency is releasing legal ownership of the transferred assets, how can the agency’s board agree to the transfer of assets to establish an agency endowment without violating its fiduciary duties?

The agency’s board must make the decision regarding whether transferring legal ownership of the funds to establish an agency endowment is consistent with its fiduciary duties. An agency’s board may decide that such a transfer is prudent and consistent with its fiduciary responsibility to the organization because of the benefits provided as a result of the relationship with the community foundation. For example, the agency may benefit from the expertise of the community foundation in long-term management of assets, the flexibility the community foundation may provide by accepting types of non-cash contributions not accepted by the agency, or the protection that the transfer will provide by establishing an endowment at a separate organization.

Can a community foundation accept a non-endowed fund from an agency?

If established properly, a community foundation may accept a non-endowed (aka spend-down) fund from an agency. The key is that the agency may not reserve the right to unilaterally withdraw the fund from the community foundation. Instead, grants to the agency must be subject to the community foundation’s approval.

Who can donate to an agency fund?

Third Party Contributions – Individual donors may not make contributions to an agency fund. Individual donors may contribute directly to the organization for the agency fund, or they may create a designated fund at the community foundation to benefit the organization. The Community Foundation for the Fox Valley Region does not support fundraising activities by your organization and cannot accept gifts into the fund from donors generated by those activities.

Legacy or Estate Contributions – A community foundation can receive distributions from charitable trusts or bequests from an estate on behalf of your organization and create a designated fund. Our team members at the Community Foundation for the Fox Valley Region work with your donors across the full range of planned contributions, including bequests, beneficiary designations, and charitable trusts to receive assets for the future of the fund. Designated funds are different from agency funds; please ask our gift planning staff for more information.

Sources:

- Council on Foundations article “FAQ: Agency Endowment Funds”

- Council on Foundations article “Accounting for Agency Endowment Funds Held at Community Foundations.”

Caveat:

The above information is being provided with general information related to the agency agreement between a non-profit agency fund and the Community Foundation for the Fox Valley Region. Each non-profit organization should consult with its own auditors, tax professionals, and legal counsel in determining the best solution for its needs. The above is not to be construed as tax, accounting, or legal advice.

Questions? Contact the Agency Funds Team here.

Brochure: View and Download our Agency Funds brochure, and learn how we partner with you to achieve your goals:

A Guide to Your Agency Funds: View and Download the Community Foundation’s comprehensive guide to Agency Funds:

Frequently Asked Questions: View and Download our FAQs to keep in your files for reference:

Meet Your Agency Funds Team: Our team will work collaboratively with you to address any needs you have, whether it is assistance with portal login, financial information, questions on grants, or assistance in growing your fund(s).

A

Advocap Self Sufficiency Fund

Alzheimer’s Association Fund

Appleton A Better Chance (ABC) Program Endowment Fund

Appleton Boychoir, Inc. Fund

Apricity Fund

Attic Theatre Fund by Frances L. Burstein

B

Bethlehem Ev. Lutheran Church Facilities Improvement Fund

Bethlehem Evangelical Lutheran Church Endowment Fund

Big Brothers Big Sisters of the Fox Valley Region, Inc. Fund

Bletzinger Rehabilitation House Fund

Dan Bongers Memorial Fund for Rebuilding Together-Fox Valley

Boys and Girls Club Fox Valley, Inc. Fund

Brewster Village Endowment Fund

The Building For Kids Endowment Fund

C

Cap Services Skills Enhancement Program Fund

Cap Services, Inc. Fund

CASA of the Fox Cities Endowment Fund

Child Care Resource & Referral Endowment Fund

Christ The Rock Community Church Fund

Christine Ann Domestic Abuse Services Fund

Neal Chudacoff-Valley Packaging Community Access Fund

Clarity Care Endowment Fund for Program Support

Community Blood Center Fund

Community Clothes Closet, Inc Fund

COTS, Inc. Endowment Fund

Covey, Inc. Fund

D

Dan Bongers Memorial Fund for Rebuilding Together-Fox Valley

E

Echoes Thrift Store Reserve Fund

Elisha D. Smith Public Library Endowment Fund

Elisha D. Smith Public Library Memorial Fund

Jan Erickson Memorial Scholarship Fund

F

Family Services of Northeast Wisconsin Fund

Feeding America Eastern Wisconsin Fund

FIRST CONGREGATIONAL UNITED CHURCH OF CHRIST FAMILY OF FUNDS

– First Congregational UCC – Lawrence Scholars Endowment Fund

– First Congregational UCC – Memorial Garden Endowment Fund

– First Congregational UCC – Memorials and Special Gifts Fund

– First Congregational UCC – Organ Preservation Fund

– First Congregational UCC – Pastor Kathryn Kuhn Memorial Fund

– First Congregational UCC – Splitt Building Maintenance Fund

First English Lutheran Church Endowment Fund

Fox Cities Curling Fund

Fox Valley Family Practice Residency, Inc. Appleton Fund

Fox Valley Humane Association Endowment Fund

Fox Valley Literacy Council, Inc. Fund

Fox Valley Sailing School John R. Galloway Memorial Fund

Fox Valley Symphony Endowment Fund

Fox Valley Symphony Youth Orchestras Fund

Fox Valley Technical College Endowment Fund

Freedom Running Club Endowment Fund

FRIENDS OF APPLETON LIBRARY FAMILY OF FUNDS

– Appleton Library Endowment Fund

– Austin and Judy Boncher Appleton Library Endowment Fund

– Friends of Appleton Library FOCOL Fund

– Friends of Appleton Library Frank P. Young Scholarship Fund

– Friends of Appleton Library Mark Towsley Fund

– Sandra and Dr. Monroe Trout Appleton Library Endowment Fund

– John and Virginia McMahon FOAL Endowment Fund

– Connie and Peter Roop Appleton Public Library Endowment Fund

Friends of the Fox River Fund

Friends of Butterfly Gardens, Inc. Fund

Friends of Mosquito Hill, Inc. Educational Endowment Fund

Friends of Neuschafer Community Library General Fund

Friends of Neuschafer Community Library Reserve Fund

Friends of the New London Public Museum Endowment Fund

Friendship Place Endowment Fund

Friendship Place Reserve Fund

Sandra L. Fuller – Thern Homestead Fund

Future Neenah Endowment Fund

G

Girl Scouts of the Northwestern Great Lakes, Inc. Fund

Goodwill Industries of North Central WI Endowment Fund

Gordon Bubolz Nature Preserve General Endowment Fund

GREATER FOX CITIES AREA HABITAT FOR HUMANITY FAMILY OF FUNDS

– Greater Fox Cities Area Habitat for Humanity Fund II

– Greater Fox Cities Area Habitat for Humanity Fund I

Gray Muzzle Organization of NE Wisconsin, Inc. Fund

OCHS Grignon Family Collections Fund

H

Harbor House Domestic Abuse Programs Endowment Fund

Harbor House Domestic Abuse Programs Long Term Fund

Harbor House Domestic Abuse Programs Reserve Fund

Hearing Loss Association of America-Fox Valley Chapter Fund

Hearthstone Endowment Fund

Heckrodt Wetland Reserve Education Fund

Hope Clinic & Care Center Fund

Houdini Fund

K

Kaukauna Alumni Foundation Endowment Fund

Kaukauna Public Library Special Projects and Programs Fund

L

Rochelle Lamm Building for Kids Fund

LEAVEN Administrative Endowment Fund

LEAVEN Administrative Endowment Fund II

LEAVEN Community Resource Center Endowment Fund

LEAVEN Endowment Fund

LEAVEN – Salmon Endowment Fund

Literacy Education Services Endowment Fund

Literacy Education Services, Inc. Reserve Fund

Lutheran Social Services Fund

M

Menominee Indian School District Eagles Scholarship Fund

Menominee Indian School District Scholarship Fund

OCHS Neils C. & Elizabeth Miller Directors’ Fund

Kayla M. Murphy Memorial Scholarship Fund

N

NAMI FOX VALLEY FAMILY OF FUNDS:

– NAMI Fox Valley – Dan Evans Memorial Fund

– NAMI Fox Valley – Dick Germiat Memorial Fund

– NAMI Fox Valley – Leona Kleinhans Memorial Fund

– NAMI Fox Valley – Dr. Roger Mosher Memorial Fund

– NAMI Fox Valley – Lucille Orbison Memorial Fund

– NAMI Fox Valley – Sue Schouten Memorial Fund

– NAMI Fox Valley Endowment Fund

Neenah Historical Society Endowment Fund

Neenah-Menasha Emergency Society Fund

New Holstein Community Chest Fund I

New Holstein Community Chest Fund II

NEW LONDON AREA SCHOOL DISTRICT FAMILY OF FUNDS:

– Stanley J. Cottrill Scholarship Fund

– Thomas F. Fitzgerald Scholarship Fund

– Laurine I. Fitzgerald Scholarship Fund

– Jagoditsch Memorial Scholarship Fund

– Lincoln Alumni Scholarship Fund

– New London Area School District Scholarship Fund

– Lindsay Smith Scholarship Fund

– Laura Turner Memorial Life Science Scholarship Fund

New London FFA Fund

New London Heritage Historical Society Heritage Village Fund

Newlt Stroebe Island Preservation Fund

newVoices Fund

O

OCHS Outagamie Museum Fund

Old Glory Honor Flight, Inc. Fund

Options for Independent Living Endowment Fund

P

Paper Industry International Hall of Fame Endowment Fund

Partnership Community Health Center, Inc. Fund

Pillars, Inc. Fund

Project Bridges Day Care Center & Preschool Fund

R

Rawhide Founders Endowment Fund

S

Samaritan Counseling Center of the Fox Valley Endowment Fund

Samaritan Staff Development & Development and Continuing Education Fund

Sexual Assault Survivor Fund

Seymour Community Museum Reserve Fund

Seymour Community Museum Sustainability Fund

William Siekman Junior Achievement Scholarship Fund

SOAR FOX CITIES FAMILY OF FUNDS:

– SOAR Fox Cities Endowment Fund

– SOAR Fox Cities Inc. – Neenah-Menasha Founding Families Fund

– SOAR Fox Cities Reserve Fund

– SOAR Fox Cities Youth Fund

ST. FRANCIS XAVIER CATHOLIC SCHOOL SYSTEM FOUNDATION FAMILY OF FUNDS:

– David Adamovich Athletic Fund

– Deacon James and Helen K. Asmuth Scholarship Fund

– Helen “Sis” Balliet Memorial Fund

– Melvin E. and R. Virginia Bartelt Scholarship Fund

– Bassett & Thrivent Empowerment Through Education Fund

– Kathy Bates Athletics Fund

– Waltera Bekkers Memorial Scholarship Fund

– Berg Family Scholarship Fund

– Agnes. M. and John J. Biese Jr. Memorial Scholarship Fund

– Rocky Bleier Scholarship Fund

– John and Evelyn Blick Memorial Scholarship Fund

– Robert and Mary Bodoh XHS Music Fund

– Fritz and Peg Brei Memorial Scholarship Fund

– John, Mary, Alice & Elsa Breitenbach Scholarship Fund

– Edward & Margaret Brill Scholarship Fund

– Margaret J. Brill Memorial Scholarship Fund

– Merlin and Joan Brunner Scholarship Fund

– Catholic Club Scholarship Fund

– Torchy Clark Fund

– J. Joseph & Rosemary Cummings Memorial Scholarship Fund

– Dr. James Curry Memorial Scholarship Fund

– Ken & Marie Day/Hilda Kitzinger Memorial Scholarship Fund

– Margaret De Jonge Memorial Scholarship Fund

– Lori Dolata Bultman Memorial Scholarship Fund

– Anna Donnermeyer Memorial Scholarship

– Herbert and Elva Dorn K-12 Support Fund

– Herbert and Elva Dorn K-8 Memorial Scholarship Fund

– Herbert and Elva Dorn Scholarship Fund

– Robert Sr. and Jacqueline Drexler Memorial Scholarship Fund

– Dr. Charles F. Dungar Memorial Scholarship Fund

– Expanding Opportunities Scholarship Fund

– Josephine Feavel Family Scholarship Fund

– Fine Arts Spark Fund, in honor of Elizabeth A. Wiltzius

– Thomas and Beulah Flanagan Scholarship Fund

– Fox Valley Health Professions Scholarship Fund

– Joseph & Marguerite Frahm Memorial Scholarship Fund

– Lawrence & Arlene Gage Scholarship Fund

– Jo (Perry) Gear Memorial Scholarship Fund

– Raymond P. Georgen Memorial Scholarship Fund

– Sena L. Gray Memorial Scholarship Fund

– Ivo and Mary Geurts Scholarship Fund

– Bob and Sue Hayes Family Scholarship Fund

– Mimi and Bill Hodgkiss Scholarship Fund

– Jude Hoffman and Lisa Kampf Memorial Scholarship Fund

– David L. Hussey Memorial Scholarship Fund

– Maureen Hussey Memorial Scholarship Fund

– Jeremy Janssen Memorial Fund

– Father Orville Janssen Memorial Scholarship Fund

– Joe & Jane Kaufman Scholarship Fund

– Klister/Livengood Scholarship Fund

– Anne M. Konz Scholarship Fund

– Anna M. Leiterman Memorial Scholarship Fund

– Dr. Leo Mack Jr. Scholarship Fund

– Martin Family Endowed Fund

– Thomas Meehl Memorial Scholarship Fund

– Ralph and Ethel Moehring Scholarship Fund

– Nienhaus Scholarship Fund

– Father Michael K. O’Rourke Education Scholarship Fund

– Dennis Oudenhoven Memorial Scholarship Fund

– Edward & Loretta Pfefferle Memorial Fund

– John and Lynn Pfefferle Scholarship Fund

– Mike Pfefferle Memorial Fund

– Lawrence and Jeannette Piette Scholarship Fund

– The Qastin Family Fund

– Rudolph Family Scholarship Fund

– Peg and Bernard Rutten Scholarship Fund

– St. Mary’s School/Catholic Central Legacy Scholarship Fund

– David Stanek Xavier Theatre Fund

– William and Margery Stilp Scholarship Fund

– Joan M. Streck Memorial Scholarship Fund

– Steven P. Van Hoof Memorial Scholarship Fund

– Josephine and Dr. Francis Van Lieshout Scholarship Fund

– Van Schyndel Family Fund

– Opal & Elmer Vanden Boogaard Scholarship Fund

– “Arnie” Vanden Boomen Memorial Scholarship Fund

– Jeffrey Vanlieshout Scholarship Fund

– Voissem Family Scholarship Fund

– Marv & Jayne Voissem Scholarship Fund

– Eunice Vosters Family Memorial Scholarship Fund

– Brian and Catherine Wallace Family Scholarship Fund

– The Weiske Family Volunteer Scholarship Fund

– Paul & Judy Werner Scholarship Fund

– Bradley Williams Memorial Scholarship Fund

– Mary Williamson Memorial Scholarship Fund

– Gladys Wisnefski Memorial Scholarship Fund

– Worachek Family Entrepreneurism College Scholarship Fund

– Xavier Business Center Fund

– Xavier Catholic Schools Capital Improvement Fund

– Xavier Catholic Schools Foundation Fund

– Xavier Catholic Schools General Scholarship Fund

– Xavier Catholic Schools Staff Development Endowment Fund

– Xavier Elementary Teacher Appreciation Fund

– Xavier High School General Operations Fund

– Xavier High School Memorial Scholarship Fund

– Xavier High School Teachers Fund

– Xavier Middle School Building Maintenance Fund

– Xavier Public Access Scholarship Fund

– Fr. John Zickert Memorial Scholarship Fund

– Gus & Helen Zuehlke Family Scholarship Fund

– The Reverend Donald M. Zuleger Scholarship Fund

– Jim and Bea Schafhauser Memorial Scholarship Fund

St. Joseph Food Program, Inc. Endowment Fund

St. Joseph Food Program, Inc. Operational Fund

St. Joseph Food Program, Inc. Operational Fund II

St. Joseph Residence, Inc. Endowment Fund

St. Joseph Residence, Inc. Mission Fund

St. Norbert College – Fox Valley Student Scholarship Fund

St. Paul Elder Services Care Assurance Endowment Fund

St. Timothy Church Endowment Fund

Clarice Stake Endowment Fund

T

Town of Clayton Community Trails Fund

Tri-County Community Dental Clinic Endowment Fund

Tri-County Community Dental Clinic Reserve Fund

The Trout Museum of Art Fund

U

United Community Services Fund

Unlock the Fox Fund

UNITED WAY – FOX CITIES FAMILY OF FUNDS

– Legacy of Caring Fund

– United Way Basic Needs and Self-Sufficiency Fund

– United Way Developing Children and Youth Fund

– United Way Fox Cities – Peter C. Kelly Endowment Fund

– United Way Fox Cities – Carolyn E. Close Fund

– United Way Fox Cities – John “Jack” Close Memorial Fund

– United Way Fox Cities – Sue and Rick Detienne Fund

– United Way Fox Cities Administrative Endowment Fund

– United Way Fox Cities – Nate and Jackie Hintz Family Fund

– United Way Fox Cities – Henry J. Hodas Fund

– United Way Fox Cities Intermediate Reserve Fund

– United Way Fox Cities Long Term Reserve Fund

– United Way Fox Cities Operating Fund

– United Way Health, Healing, and Crisis Intervention Fund

– United Way Strengthening Families Fund

V

Valley Packaging Industries Endowment Fund

Villa Phoenix Fund

Volunteer Center of East Central Wisconsin Fund

Volunteer Fox Cities Future Fund

W

WISCONSIN ASSOCIATION FOR LANGUAGE TEACHERS FAMILY OF FUNDS:

– WAFLT Distinguished Educator Fund

– WAFLT Endowment Fund

– WAFLT Professional Development Scholarship Fund

– WAFLT Student Travel Scholarship Fund

Contact us here To establish a new agency fund, contact Michelle Lippart Hardwick, Director of Gift Planning 920.702.7622

To establish a new agency fund, contact Michelle Lippart Hardwick, Director of Gift Planning 920.702.7622

Office Phone

Address

4455 W. Lawrence St

Appleton, WI 54914

map it

Office Hours

8:00am - 11:30am

and noon - 4:00pm

Monday-Friday