Prudent Investing for the Future

Our investment strategy

The Community Foundation prudently invests charitable funds so they may strengthen the community for current and future generations, carrying out our generous donors’ wishes to impact their communities and make a difference in the lives of others.

The Community Foundation’s investment strategy is managed by our Outsourced Chief Investment Officer (OCIO) Fund Evaluation Group (FEG) Investment Advisors, whose advisors are working with our volunteer investment committee members, who are local experts in investment and finance.

With our OCIO approach, we set the investment policy and strategic direction to ensure that performance meets or exceeds expectations. FEG performs the research, hires the investment managers and has discretion to make the portfolio decisions real-time without the delays in decision-making that can be common for endowments.

Our commitment

The Community Foundation’s investment strategy is designed to preserve and grow capital, helping to ensure that donors’ charitable assets benefit the community now and for generations to come. Portfolios embrace diversification and active management. This strategic approach helps guard against short-term market swings while still providing the opportunity for long-term gains.

The Community Foundation and our investment committee are responsible to establish the investment policy and strategic direction. The OCIO is empowered to select and manage the investment managers within the approved policy, while remaining accountable to the Community Foundation for results.

Why FEG?

We selected FEG as our OCIO partner due to its strong and extensive institutional experience. FEG works with more than 40 community foundations across the nation, and 90% of the firm’s OCIO institutional clients are nonprofits. FEG has over $65 billion under advisement, and consistently outperforms financial benchmarks. FEG’s expertise will help provide the financial footing necessary to support our philanthropic mission.

Performance

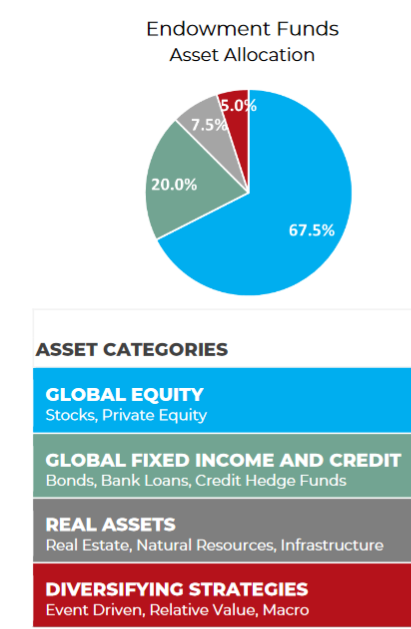

The Community Foundation has separate asset allocations for its long-term endowment portfolio and three non-endowed portfolio options, based on donor-intended timing for charitable distributions.

View our PORTFOLIO UPDATE for the 4th Quarter of 2023

View the 2023 Investment Performance Review letter

Information provided by FEG, Cincinnati, Ohio.

Please note: The Community Foundation’s fiscal year is from January 1 to December 31.

Contact the Community Foundation if you have any questions: 920.830.1290, or [email protected].