How much do I need?

A minimum of $10,000 ($15,000 for scholarships) is required to begin grantmaking. However, a Future Fund can be started with a minimum of $1,000.

How long will the fund last?

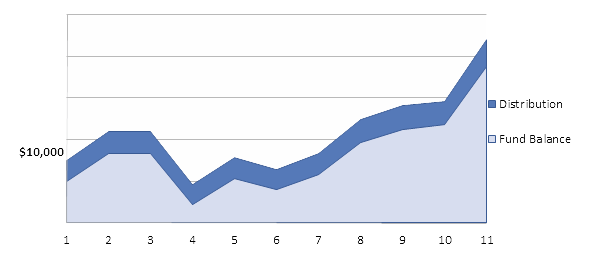

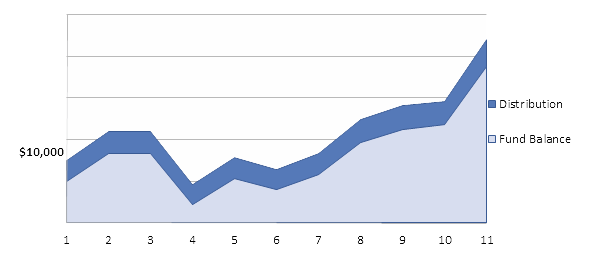

You decide the time frame for your giving. Many donors choose to create a permanent endowment to support their favorite causes in perpetuity with a gift of $10,000 or more ($15,000 for scholarship funds). An endowed fund may distribute up to 4.5% of its asset value each year. The balance remains invested for future years. If a permanent endowment does not suit your charitable goals, you may establish a non-endowed fund. Grants may be awarded from the fund in any amount, and at any time. If all fund assets are distributed, the fund will be closed. No minimum gift amount or balance applies to non-endowed funds.

As investment returns vary, so will the distribution amount, as shown to the right:

(This chart is an illustration only. While investment performance cannot be guaranteed, the Foundation strives to preserve the purchasing power of endowed funds over the long term.)

What to Give

When you establish a charitable fund, your contribution is fully tax deductible to the extent allowable by law. Additionally, funds can be opened with most types of assets—cash, stock, property—and can also receive legacy and planned gifts. Note: Under current law, IRA transfers to donor advised funds don’t qualify, but other types of funds do qualify

What’s allowed?

Generally, organizations eligible to receive grants from the Community Foundation for the Fox Valley Region are those determined by the IRS to be public charities. This encompasses most charitable, scientific, social service, educational and religious organizations described in Section 501(c)(3) of the U.S. tax code, as well as government agencies. We encourage you to contact the Community Foundation if you have any question about an organization’s charitable status.

Here to help

Michelle Lippart Hardwick

Director of Gift Planning

920.702.7622

[email protected]

_____________________________________________________________________

More giving options for GIVING NOW from your Cash, Securities, Real Estate, Personal Property, Business Interests, or from your IRA

Even more giving options for GIVING LATER from a Bequest, Charitable Remainder Trust, Charitable Lead Trust, Charitable Gift Annuity, Retirement Assets, Life Insurance, or Life Estate.

Creating a fund should be an enjoyable experience, and that’s why we make giving as easy as possible. We meet personally with donors to determine goals and create a fund that makes sense for you.

Creating a fund should be an enjoyable experience, and that’s why we make giving as easy as possible. We meet personally with donors to determine goals and create a fund that makes sense for you.